How To Get The Lowest Mortgage Rates Amidst Mortgage Rules Changes

We all want the lowest mortgage rates we can get because even saving a fraction of a percent on your interest rate can save you thousands of dollars over the life of your mortgage loan.

Your mortgage rate is unique to you and your circumstances. To know what rate you really qualify for, you’ll have to get a mortgage quote based on supplying specific information that help determine the amount of mortgage loan and the rate you qualify for.

Get a personalized mortgage rate quote from here.

Today, in Canada, “the factors that affect the mortgage rate you get” has become a huge topic.

Because, over the course of the last five years, The Bank of Canada, CMHC and Department of Finance have initiated at least 30 different mortgage rule changes (some small, some large).

With that in mind, we are laying out four factors that impact mortgage rates that you can control and do something about. Read them over so that you can prepare and be in the best position to be given a low rate.

Credit Scores (it’s a big deal)

A low credit score will make it impossible to get a lower rate. Lenders use your credit score as an indicator of how likely you are to be successful at paying back your loan. If you have trouble paying back smaller loans like credit card debt, then you are more likely to struggle with paying down larger debts like a mortgage.

The minimum credit scores needed to get approved for a mortgage is 640, though it would be more accurate to say that anywhere between 620 and 680 would be considered a minimum, depending on the lender.

If your score falls below 640, it doesn’t mean you can’t get approved for a mortgage, but it does mean you’ll have to seek out alternative lenders. Of course, this means you’ll probably end up paying more in interest too.

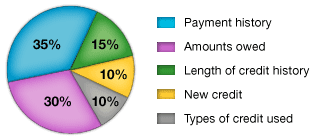

Put in some effort to improve your credit score, that way you’ll increase your odds of getting approved at a lower interest rate. The image below shows the components that affect your credit (FICO) score:

Before you start applying for a mortgage in Ontario, your first step should be to check your credit, and review your credit reports for errors. If you find any errors, dispute them with the credit reporting company.

Income (before taxes)

After your credit score, be ready to share your full financial profile including income, assets, and expenses.

When it comes to income, these are some of the questions you will be asked, are you:

- Self-employed?

- Salaried?

- Receive a Bonus?

- Hourly income?

A lender is less likely to view you as a risk if you have a good income because you’re more likely to be able to pay all your obligations every month.

On the other hand, a high income may not help you get a better mortgage interest rate if your fixed expenses, such as your rent or mortgage payment, are especially high.

If you are self-employed or on an hourly income, there’s just a bit more to do. We, at Butler Mortgage, can help you get a personalized mortgage rate quote.

Non-Mortgage Debts (LOC, credit cards, car loans)

Your total debt-to-income ratio must be 43% or lower to qualify for a loan with a reputable lender. Lenders allow some flexibility depending on your credit score. Someone with a lower credit score needs to meet the 43% limit, but if your score is on the higher side, mortgage lenders may allow a ratio as high as 50%.

If you have a LINE OF CREDIT (LOC), take note of this: “We have to assume you’ve used it.”

A recent change in several of the largest banks in Canada stipulates that all mortgage professionals must assume that if someone has a line of credit (LOC), that the full LOC balance has been used (even if $0 balance) and also apply a 3% payment to it!

Here’s an example of the application of the “3%”:

If you have $60,000 debt for a line of credit and paying only $48/month, mortgage professionals must assume 3% in addition; thereby, making it $108/month instead of $48/month.

This is the same for all non-mortgage debt balances.

Bear in mind that for every $450 of monthly [debt] obligations, it reduces the mortgage you can qualify for by [about] $100,000.

Contact us for any questions or concerns on this change that all big banks are adapting with some like RBC and TD Canada Trust have already done so (at the time of this writing, January 2020).

Stress Test

One of the new mortgage rules that many people find a bit confusing is the requirement that all Canadian home buyers pass a “mortgage stress test”.

This new rule forces us to assume that no matter what rate we get for you, we have to pretend that it is about 70% higher than it is when we calculate debt ratio.

The stress test is a calculation that answers this question:

Could you still afford to pay your mortgage if interest rates went up?

The stress test makes sure that you can still make your mortgage payments even if interest rates go up, for example, five years from now (when your 5-year term is over).

Your stress test results determine whether you qualify for the mortgage you want. The stress test applies to all homebuyers, even when they are making a 20% down payment.

The mortgage stress test became a way to SLOW DOWN HOUSE PURCHASES and force people to get lesser amount of mortgage.

Here’s one rule of thumb to use when calculating how much mortgage you can afford is to aim for a mortgage no larger than four times your income.

Get a Mortgage Quote (No Obligation)

The above is just a short list of factors that affect the mortgage rate you can get in Canada. Other factors cause other complications.

At Butler Mortgage, we offer a no-fee, no obligation mortgage approval and mortgage quote that help simplify the entire process. We do a lot of the heavy lifting, shopping and contacting multiple lenders on your behalf. And, we can do all of this over the phone.

If you are in the market for a home purchase, mortgage renewal, mortgage refinancing, debt consolidation, CONTACT US any time and let’s start the discussion.

Leave A Comment