Mortgage Pre-Approval Checklist

The mortgage process is not nearly as fun and exciting as looking at homes, listings and touring open houses. But, it can be. It can certainly increase your confidence in the process and remove the anxiety and stress of not knowing if you can get a mortgage for the house you want.

Your house hunting should begin with a MORTGAGE PRE-APPROVAL process.

Mortgage pre-approval is basically a promise from a lender that you’re qualified to borrow up to a certain amount of money at a specific interest rate, subject to a property appraisal and other requirements. You will typically get a pre-approval letter which you will be able to provide to seller/agent who will take your offer more seriously. It will also help increase your negotiating power.

At Butler Mortgage, we have a wide range of lender network across Canada that we work with for our clients to get them the best mortgage rate and solution that they need.

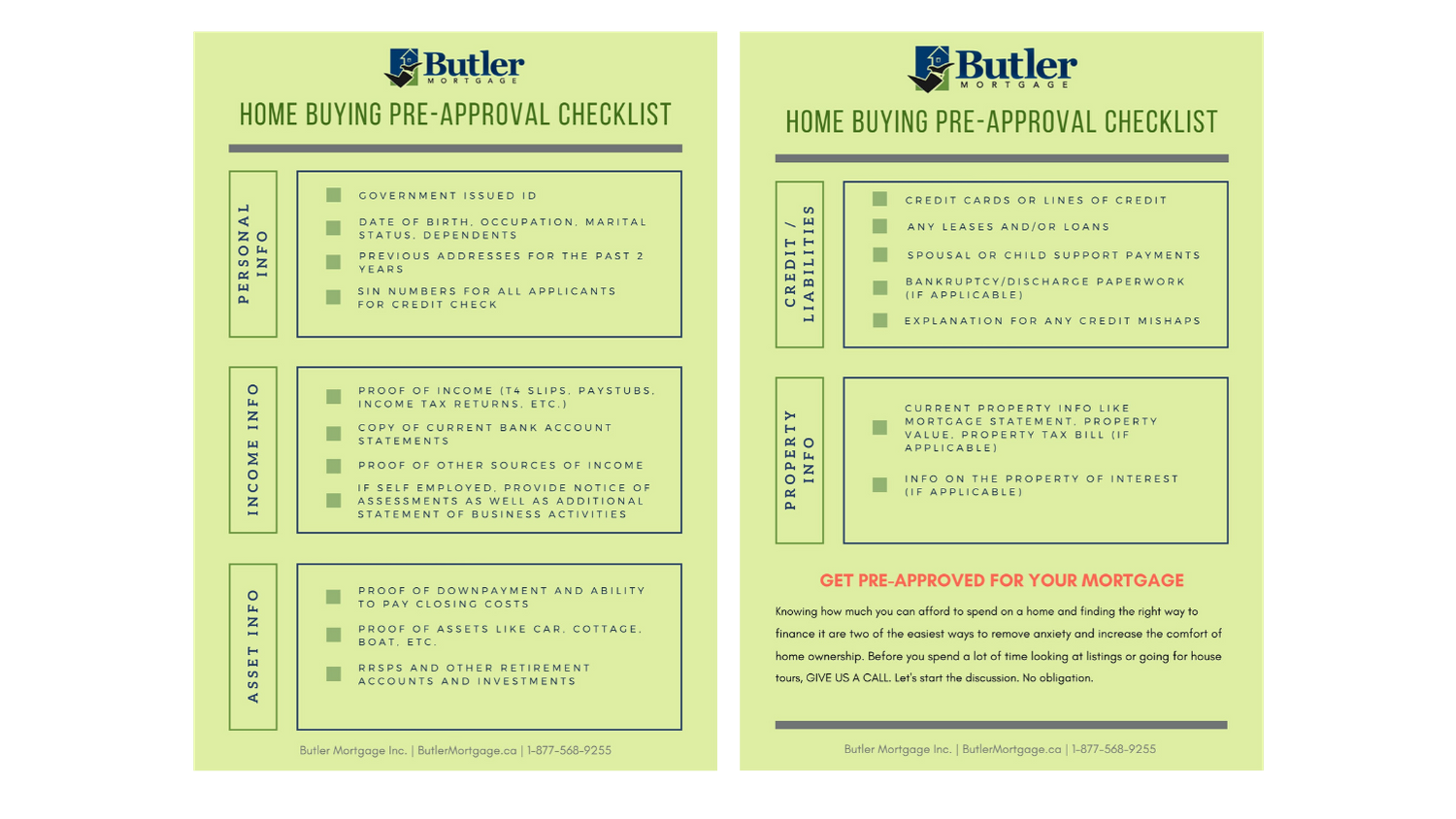

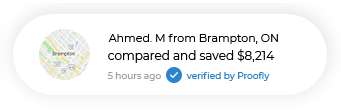

We’ve come up with a MORTGAGE PRE-APPROVAL CHECKLIST that you can download to help you organize and prepare for the process.

It includes what you’ll need for:

- Personal information

- Income

- Assets

- Credit and liabilities

- Property (current property and/or property of interest where applicable)

CLICK HERE TO DOWNLOAD CHECKLIST (PDF FORMAT)

When Can You Start Shopping Around For a Home?

The mortgage pre-approval process may take one to three days, and after you are pre-approved, you will receive a pre-approval letter as evidence that you have a lender that has already verified your assets. The letter is typically valid for 90 to 120 days; however, it can be updated with re-verification of the information.

Once you receive the pre-approval letter, you will want to start shopping around for the next 60 days. Going beyond this time-frame may actually have a negative impact on your credit score because of the inquiries that will hit your credit profile.

The next step is to start the discussion with one of our experienced Butler Mortgage agents. No obligation.

Get a Mortgage Quote (No Obligation)

At Butler Mortgage, we offer a no-fee, no obligation mortgage approval and mortgage quote that help simplify the entire process. We do a lot of the heavy lifting, shopping and contacting multiple lenders on your behalf. And, we can do all of this over the phone.

If you are in the market for a home purchase, mortgage renewal, mortgage refinancing, debt consolidation, CONTACT US any time and let’s start the discussion.

Leave A Comment